| . |  |

. |

Beijing (AFP) Nov 10, 2009 Property prices in major Chinese cities picked up in October, government data showed Tuesday, as people scrambled to buy amid fears that tax breaks and other favourable policies may soon be withdrawn. Prices of real estate in 70 medium and large cities in China rose 3.9 percent last month from a year earlier and 0.7 percent from September, the National Bureau of Statistics said in a statement on its website. The index accelerated from a 2.8-percent on-year growth in September. October marked the fifth successive year-on-year increase after the index slumped in the six months from December due to government attempts to rein in runaway prices and as the global economic crisis kicked in. Beijing has introduced a series of measures in the past year, including tax breaks, to support the real estate sector, which accounts for more than 20 percent of urban fixed investments, a key driver of China's economic recovery. But rumours have been circulating that the government might withdraw these policies at the end of the year due to concerns about asset bubbles and as the recovery of the world's third largest economy appears to be strengthening. Data showed property sales across the country surged sharply after the October 1 national holiday, with Beijing leading the way with a 36.9-percent rise last month from September, according to Tuesday's China Business News. The Chinese economy grew by 8.9 percent in the third quarter -- the fastest pace in a year -- after expanding by 7.9 percent in the second quarter and 6.1 percent in the first three months, the slowest pace in more than a decade. Share This Article With Planet Earth

Related Links The Economy

China hopes US keeps deficit to 'appropriate size': Wen

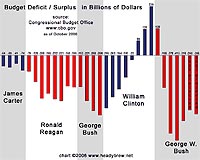

China hopes US keeps deficit to 'appropriate size': WenSharm El-Sheik, Egypt (AFP) Nov 8, 2009 Chinese premier Wen Jiabao said on Sunday he was encouraged by signs of an economic recovery in the United States, but hoped it would keep its budget deficit to an "appropriate size" to stabilise the US dollar exchange rate. "We follow very closely China's holdings of US assets, because that is a very important part of our national wealth," Wen told a media conference at the Egyptian resort ... read more |

|

| The content herein, unless otherwise known to be public domain, are Copyright 1995-2009 - SpaceDaily. AFP and UPI Wire Stories are copyright Agence France-Presse and United Press International. ESA Portal Reports are copyright European Space Agency. All NASA sourced material is public domain. Additional copyrights may apply in whole or part to other bona fide parties. Advertising does not imply endorsement,agreement or approval of any opinions, statements or information provided by SpaceDaily on any Web page published or hosted by SpaceDaily. Privacy Statement |