| . |  |

. |

Brussels (UPI) Jul 23, 2010 Seven of 91 banks -- none of them major institutions -- failed a European-wide series of stress tests aimed at restoring confidence in the European banking sector. The seven banks -- one from Germany, five from Spain and another one from Greece -- would not survive another deep recession, the tests conducted by the Committee of European Bank Supervisors indicate. In total, the European test sampled 91 banks from 20 EU member states, representing 65 percent of the EU banking sector in terms of assets, the CEBS said. The good news is that 84 banks passed the test. It simulated a two-year-long recession, losses to government debt and an ensuing finance market crisis, measuring each bank's core capital ratio at the end of that hypothetical development. The European Central Bank, the European Commission and national supervisory authorities had called on the CEBS to conduct the stress test after a similar one in the United States last year. Of the 14 German banks tested, only one failed. The capital ratio of Hypo Real Estate dropped to 4.7 percent, well below the 6 percent hurdle banks had to take in the harshest scenario. The poor result was expected: Due to risky speculation, HRE had been close to bankruptcy in the fall of 2008 and was only saved by a government bailout. Two other banks, Deutsche Postbank, a consumer bank, and Nord/LB passed the test but performed poorly, with a 6.6 percent and 6.2 percent core capital ratio, respectively. Authorities in Germany were nevertheless confident after the publication of the stress test results. "German banks prove to be robust and resilient," Germany's central bank, the Bundesbank, said in a statement. Most of the problems surfaced in Spain, where five cajas, as the region lenders are called, failed the test. They are Espiga, Diada, Banca Civica, Cajasur and Unnim. The Greek banking system seems to be healthier than expected -- only the country's ATEbank didn't make the cut. For those banks that failed the test "the competent national authorities are in close contact with these banks to assess the results of the test and their implications, in particular in terms of need for recapitalization," the CEBS said in a statement. Germany and Spain have already created funds to help weak banks get back on their feet. In Spain, expect more regional lenders to merge to speed up recapitalization. Meanwhile, critics have complained that the stress tests were not rigorous enough. "What is being called a stress test here doesn't even simulate a real stress scenario," Wolfgang Gerke, a banking specialist at the state-government sponsored Bavarian Financial Center in Munich told German public broadcaster ARD.

Share This Article With Planet Earth

Related Links The Economy

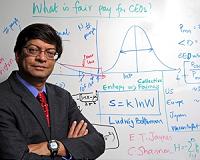

'Econophysics' Points Way To Fair Salaries In Free Market

'Econophysics' Points Way To Fair Salaries In Free MarketWest Lafayette IN (SPX) Jul 23, 2010 A Purdue University researcher has used "econophysics" to show that under ideal circumstances free markets promote fair salaries for workers and do not support CEO compensation practices common. The research presents a new perspective on 18th century economist Adam Smith's concept that an "invisible hand" drives a free market economy to a collective good. "It is generally believed th ... read more |

|

| The content herein, unless otherwise known to be public domain, are Copyright 1995-2010 - SpaceDaily. AFP and UPI Wire Stories are copyright Agence France-Presse and United Press International. ESA Portal Reports are copyright European Space Agency. All NASA sourced material is public domain. Additional copyrights may apply in whole or part to other bona fide parties. Advertising does not imply endorsement,agreement or approval of any opinions, statements or information provided by SpaceDaily on any Web page published or hosted by SpaceDaily. Privacy Statement |