| . |  |

. |

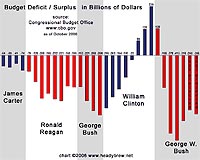

College Park, Md. (UPI) May 13, 2010 The day of the Flash Crash -- Thursday, May 6 -- I was asked at an executive seminar in New Jersey, what impact Greece would have on equity markets. I replied, "It should all be over by Wednesday." Markets fully recovered by Wednesday; however, truth in advertising requires I report that I took the podium after the Dow Jones industrial average had fallen more than 250 points owing to Greek worries but prior to the computer trading blitz that created the now famous V pattern of stock prices in just about an hour. My Blackberry off, no one alerted me to the panic unfolding on Wall Street. Now that stocks have made up all their lost ground, what's next? Good things! Long-term doubts about the efficacy of the Greek bailout, huge U.S. budget deficits and monetary ease and oil gushers not withstanding, we are in for one heck of a ride the balance of this year. A moderate recovery -- 3 percent gross domestic product growth -- and much more robust growth in Asia are good for the profits of large U.S. multinationals. S&P 500 companies earn about half their profits abroad and the economic recovery is strongest in China, where U.S. companies are quite well-positioned. Seventy-seven percent of the S&P 500 companies that have reported first-quarter earnings have outperformed analysts' estimates. Add low inflation and a favorable interest rate environment into 2011. For all the chatter about the Fed injecting too much liquidity and instigating inflation, consumer prices, less petroleum products, remain remarkably tame for now. And gasoline prices are expected to decline for the summer driving season. The Federal Reserve can focus on boosting employment and wait until early next year, or even later, to address price stability. It will likely hold short rates near zero until 2011 and international investors seeking safe haven in the dollar will keep U.S. long rates low through the end of the year, too. Corporate bonds are finding ready buyers again and investors will continue to accept lower premiums for risks on long-term company debt than in 2009. All that will drive U.S. private money off the sidelines and back into U.S. equities. Doubts about Chinese and other Asian stock and real estate markets will drive smart foreign money to the companies that can exploit Asian growth but are insulated from the vagaries and potential missteps of state-directed capitalism in China and elsewhere. U.S companies with significant market presence in China and elsewhere in Asia will attract big foreign capital inflows. Manufacturing is expanding again and these businesses have learned how to get by with a lot less labor. Manufacturing profitability should improve strongly. Like it or not, President Barack Obama's new health plan is law and that removes much uncertainty for the pharmaceutical, health device and insurance industries. Robust innovation continues in the pharmaceutical, microelectronics, consumer device, auto and materials industries. For all the epitaphs written about American engineering leadership, Intel, Apple, GE and other U.S. companies continue to lead. Ford is the poster child for American industrial recovery and GM is poised to gain market share, too, without the usual pricing gimmicks. The market value of U.S. intellectual property continues on a straight north compass heading, significantly raising the intrinsic values of many U.S. companies. Residential construction is stabilizing. Non-bank financial services are doing even better. Investment banks may need better regulatory moorings but American financial engineering remains a value harvesting machine. The ride may be bumpy but the DJIA is headed for 12,000 by year-end and 13,000 in 2011. (Peter Morici is a professor at the Smith School of Business, University of Maryland, and former chief economist at the U.S. International Trade Commission.) (United Press International's "Outside View" commentaries are written by outside contributors who specialize in a variety of important issues. The views expressed do not necessarily reflect those of United Press International. In the interests of creating an open forum, original submissions are invited.)

Share This Article With Planet Earth

Related Links The Economy

Outside View: Trade deficit

Outside View: Trade deficitCollege Park, Md. (UPI) May 12, 2010 The U.S. Commerce Department reported the March deficit on international trade in goods and services increased to $40.4 billion from $39.4 billion in February. The trade deficit, along with the credit and housing bubbles, were the principal causes of the Great Recession. Now, a rising trade deficit and continued weakness among regional banks threatens to stifle the emerging recovery and ... read more |

|

| The content herein, unless otherwise known to be public domain, are Copyright 1995-2010 - SpaceDaily. AFP and UPI Wire Stories are copyright Agence France-Presse and United Press International. ESA Portal Reports are copyright European Space Agency. All NASA sourced material is public domain. Additional copyrights may apply in whole or part to other bona fide parties. Advertising does not imply endorsement,agreement or approval of any opinions, statements or information provided by SpaceDaily on any Web page published or hosted by SpaceDaily. Privacy Statement |