| . |  |

. |

Zurich (AFP) May 6, 2010 Swiss Re, one of the world's biggest reinsurers, on Thursday reported a surge in first quarter profit although its results were dampened by losses from Chile's earthquake and European storm Xynthia. Net profit rose by 21 percent to 158 million dollars (116 million euros) in the first three months of 2009 against 130 million dollars a year earlier, the company said in a statement. "In the first quarter of 2010, we continued to deliver strong underlying performance, even though the result was impacted by high natural catastrophe losses, mainly from the earthquake in Chile and European winter storm Xynthia," said chief executive Stefan Lippe. "While natural catastrophes like these can contribute to earnings volatility, protecting our clients against such extreme events is the essence of our business model," he added. The company's quarterly net profit had reached 403 million Swiss francs (362 million dollars, 281 million euros) in the final three months of 2009. The reinsurer provisionally estimated that it would have to foot about 200 million dollars of losses from the Deepwater Horizon oil rig blast in the Gulf of Mexico on April 20. The total insurance industry payout could reach 1.5 billion to 3.5 billion dollars, it added in a provisional estimate of the cost of the disaster to the industry. Swiss Re said it had to foot about 500 million dollars in claims from the 8.8-magnitude quake and a tsunami that struck south-central Chile on February 27, killing 486 people. Swiss Re's share of the insurance payout after storm Xynthia, which left 62 people dead when it struck the Atlantic and North Sea coasts of Europe in March, reached 100 million dollars. Those claims offset a strong revival from record losses in the financial crisis by depressing operating income in the company's property and casualty division, which dropped by 69 percent year-on-year to 259 million dollars in the first quarter. Swiss Re said it had further strengthened capital reserves that had been were severely eroded by massive investment losses in the financial crisis. By the end of March, core excess capital increased to more than 12 billion dollars. The company gave a cautious outlook on the year ahead, as it hoped that recent disasters would help re-evaluate risk and allow insurance pricing to recover. "Primary insurance volumes and prices remain under pressure, delaying the hardening of the reinsurance market," said Lippe.

Share This Article With Planet Earth

Related Links Bringing Order To A World Of Disasters A world of storm and tempest When the Earth Quakes

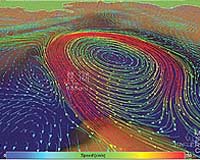

Florida's fear: Gulf current could bring oil slick its way

Florida's fear: Gulf current could bring oil slick its wayMiami (AFP) May 6, 2010 The Florida Keys at first glance appeared safe from the huge Gulf of Mexico oil spill lapping the US coast, but they are now awash in fear that a powerful undersea current could bring the slick streaming into the fragile ecosystem. The tourist haven is some 500 miles (800 kilometers) from the massive slick floating just off Louisiana. But should the unpredictable Loop Current - part of the ... read more |

|

| The content herein, unless otherwise known to be public domain, are Copyright 1995-2010 - SpaceDaily. AFP and UPI Wire Stories are copyright Agence France-Presse and United Press International. ESA Portal Reports are copyright European Space Agency. All NASA sourced material is public domain. Additional copyrights may apply in whole or part to other bona fide parties. Advertising does not imply endorsement,agreement or approval of any opinions, statements or information provided by SpaceDaily on any Web page published or hosted by SpaceDaily. Privacy Statement |