| . |  |

. |

Buenos Aires (UPI) Jan 8, 2009 Political tensions are running high in Argentina after President Cristina Fernandez de Kirchner swept Central Bank chief Martin Redrado out of office for resisting government demands to use reserves to pay off the nation's debts. Amid opposition outcries of "illegal" and "unconstitutional" measures by Fernandez, turmoil reigns within the political spectrum in the aftermath of Redrado's swift removal and installation of his deputy, Miguel Pesce, as interim president of the Banco Central. The crisis flared when Redrado declined the government's requests to release $6.6 billion of the reserves for debt repayments. Exact details of the debt repayment were not revealed but official sources said the total referred to amounts due in 2010 for debt servicing and repayments. Fernandez aides explained the debt repayments were critical to a financial fightback launched by Fernandez last year, as part of the government's strategy to return to the financial markets. Argentina has been shunned by the markets or has avoided any serious approach after plunging the financial community into a crisis of confidence over the $95 billion debt default of 2001. Although Argentina never quit the International Monetary Fund, its contact with the IMF was minimal through the intervening years until it was revived in 2009. The IMF gave Argentina an enthusiastic welcome but also announced plans to do a financial review of the nation's economy, a routine exercise. Argentine analysts said the country was not yet ready for the grueling investigations that would ensue and most likely would not be to Argentina's benefit. Critics of Fernandez say the government needs to carry out a series of major fixes in Argentine economy before opening it to the scrutiny of the global financial community. Argentine exports suffered in the global downturn and key sectors have languished amid a chronic shortage of investment. Despite the reversals, however, Argentina remains Latin America's second largest economy, trailing only Brazil. Redrado supporters point out that the Central Bank bounced back amid deep uncertainties and built its reserves to $48 billion from $8.2 billion in January 2003. In 2006 the bank dipped into its coffers to pour $10 billion into debt repayments. Redrado, a Harvard graduate, is no stranger to controversy. In 1994 he confronted former President Carlos Menem over a government plan for pensioners to sell shares they had been granted in YPF S.A., the oil company, and was fired as a result from the regulatory commission CNV. Although Fernandez's order sacking Redrado was backed by 14 Cabinet members, the resulting recrimination dismayed economic analysts who expressed fears the dispute would discourage investors from considering Argentina as a destination for new finance, Argentine media reported. New questions also arose over the veracity of government statistics on inflation. Independent data on Argentine inflation suggest the figure may be 18 percent and not 8 percent as claimed by Fernandez aides, MercoPress reported.

Share This Article With Planet Earth

Related Links The Economy

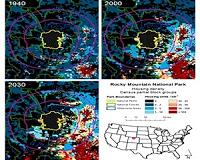

Conservation Areas Threatened Nationally By Housing Development

Conservation Areas Threatened Nationally By Housing DevelopmentMadison WI (SPX) Jan 08, 2010 Conservationists have long known that lines on a map are not sufficient to protect nature because what happens outside those boundaries can affect what happens within. Now, a study by two University of Wisconsin-Madison scientists in the department of forest and wildlife ecology measures the threat of housing development around protected areas in the United States. In a study published thi ... read more |

|

| The content herein, unless otherwise known to be public domain, are Copyright 1995-2009 - SpaceDaily. AFP and UPI Wire Stories are copyright Agence France-Presse and United Press International. ESA Portal Reports are copyright European Space Agency. All NASA sourced material is public domain. Additional copyrights may apply in whole or part to other bona fide parties. Advertising does not imply endorsement,agreement or approval of any opinions, statements or information provided by SpaceDaily on any Web page published or hosted by SpaceDaily. Privacy Statement |