| . |  |

. |

Istanbul (AFP) Oct 1, 2009 The International Monetary Fund on Thursday lifted its growth forecast for China's economy this year to 8.5 percent, saying the Asian giant was helping to drive the region's recovery. The IMF's new forecast, made in its twice-yearly World Economic Outlook report, was two percentage points higher than its April forecast of 6.5 percent -- and above the eight percent the government sees as key to social stability. But the Washington-based body warned that rapid credit growth in the world's third-largest economy risked creating asset bubbles and bad loans which could derail the Chinese revival. "Recent indicators point to a strengthening recovery (in Asia) led by a rapid rebound in China, where growth accelerated to an annual rate of 7.1 percent in the first half of the year," the IMF said. "China and India will lead the expansion this year and will grow at rates of 8.5 and 5.4 percent, respectively, boosted by large policy stimulus that is increasing demand from domestic sources." Beijing last year unveiled a massive four-trillion-yuan (585-billion-dollar) stimulus package to jumpstart domestic spending in its export-driven economy, as orders from key markets the United States and Europe plummeted. Before the global crisis struck, China had experienced double-digit annual growth from 2003 to 2007 and again in the first two quarters of last year. China's economy slumped to 6.1 percent growth in the first quarter of 2009, the slowest pace in 20 years, as the global financial crisis hit the country's manufacturing sector, which accounts for more than 40 percent of the economy. But it staged a strong rebound in the second quarter, with 7.9 percent growth. The Chinese government sees eight percent growth as essential for job creation and keeping a lid on social unrest. The turnaround has been fuelled by the massive government spending, 7.4 trillion yuan in bank lending in the first half and low interest rates. But the IMF warned that loose monetary policy and the flood of bank lending could derail the economic recovery. "Maintaining credit growth at this level carries the risk of creating incentives for over-investment, unsustainable asset price inflation and a worsening of credit quality in the banking system," the IMF said. "Recent monetary expansion should therefore be unwound as soon as there are clear signs that economic recovery is established." Despite the amount of money flowing into the economy, the IMF said it expected consumer prices to fall 0.1 percent this year, before rising by 0.6 percent in 2010. The consumer price index, the main gauge of inflation, fell 1.2 percent in August year-on-year, marking the seventh consecutive monthly decline, the government has said. The IMF report comes after the Asian Development Bank last week boosted its growth outlook for China to 8.2 percent in 2009 and 8.9 percent in 2010. Share This Article With Planet Earth

Related Links The Economy

China manufacturing steady in September: index

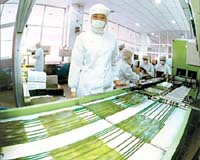

China manufacturing steady in September: indexShanghai (AFP) Sept 30, 2009 China's manufacturing activity continued to expand at a steady rate in September, as domestic and overseas demand continued to improve, an independent survey published Wednesday indicated. The HSBC China Manufacturing PMI, or purchasing managers index, fell slightly to 55.0 in September, from 55.1 in August. A reading above 50 nevertheless means the sector is expanding, while a reading ... read more |

|

| The content herein, unless otherwise known to be public domain, are Copyright 1995-2009 - SpaceDaily. AFP and UPI Wire Stories are copyright Agence France-Presse and United Press International. ESA Portal Reports are copyright European Space Agency. All NASA sourced material is public domain. Additional copyrights may apply in whole or part to other bona fide parties. Advertising does not imply endorsement,agreement or approval of any opinions, statements or information provided by SpaceDaily on any Web page published or hosted by SpaceDaily. Privacy Statement |