| . |  |

. |

Frankfurt, Germany (UPI) Jun 28, 2010 It would be understandable if people outside the financial markets missed the new euro crisis. Between them, the soccer World Cup and the BP oil spill, the Group of 20 summit and the changing of the guard in Afghanistan have swept everything else off the front pages. But the yields on Greek bonds have risen to more than 10 percent once more. And Portuguese bond yields have also bumped up to 5.7 percent while Spanish yields are heading ominously toward 5 percent, which is higher than they were when the eurozone announced its stunning trillion-dollar package to stabilize the euro. In short, the markets have looked at that big trillion-dollar stick and decided that its supposed shock-and-awe effect is neither shocking nor inducing very much awe. The markets think the euro problems aren't going away. A trillion dollars doesn't buy much respect these days. By contrast, yields on British bonds have been dropping, which means that against all financial logic the United Kingdom is looking like a safe haven -- despite that mammoth budget deficit of 11 percent of gross domestic product. The implications of this are grim. The markets aren't prepared to buy Greek bonds at all and are demanding much higher interest rates to buy Spanish or Portuguese debt and they are even starting to take a beady-eyed look at French bonds. So the European Central Bank, which has already spent more than $62 billion in buying the bonds of its weaker members is going to have to do more and start dipping into the $544 billion that have been pledged (but so far not paid) into the European Financial Stability Facility. Even if Germany wins the World Cup, the voters and the parliament are going to notice amid their celebrations that more of their hard-earned savings are heading south once more. This isn't only a European problem; it is very troubling for China, since its currency has risen by 14 percent this year against the euro. That is the price China has been paying for its dollar peg (fixing its exchange rate against the dollar), even though Europe long since overtook the United States as China's largest export market. In fact, the rise in the yuan against the euro was one of the factors that really prompted China to announce its loosening of the dollar peg, since Chinese officials hoped they could benefit from any subsequent rise in the euro. Another factor was China's desire to pre-empt that kind of kind of pressure that was looming at the G-20 summit, with all the other countries calling on Beijing to revalue against the dollar. But the new euro crisis has dampened those hopes. And it could get worse. The renewed problems of the southern eurozone countries means that they will sharply be cutting imports. Last year, Spain, Italy, Greece, Portugal and France between them accounted for 20 percent of the world's total trade deficits. And China accounted for 26 percent of the world's total trade surpluses. If the euro southerners stop buying, China hurts. This is why some heavyweight economists like Professor Michael Pettis of Beijing University's Guanghua School of Management are suggesting that the euro won't survive in its current form; that the European crisis will be accompanied by a global trade shock; and that "this is the Big One." Pettis explains this as follows: "The current set of crises, beginning with the sub-prime crisis in the U.S. and spreading throughout the world, is not a short-term liquidity crisis like LTCM, the Asian Crisis, or the Mexican crisis of 1994. I think this is likely to be one of those big events, one that represents a major readjustment in the world during which time the massive imbalances that had been built up during the long globalization cycle that started around the late 1980s and early 1990s are finally worked out. Not only will Greece, in other words, get worse, but it is by no means the end of the crisis. A lot more countries in Southern Europe, Latin America and Asia are going to be caught up in this before it ends." By comparison with that, even an inveterate pessimist like Albert Edwards of Societe Generale sounds positively moderate when he predicts a double dip recession with deflation, starting by the end of this year. Even one of the usual economic optimists, Professor Sebastian Edwards of UCLA, has turned pessimist. Half of the members of the Fed in Washington are urging another burst of stimulus for the stalled economy and the resignation of White House budget director Peter Orszag now seems to have been triggered by his objections to yet more deficits. The broad context within which this weekend summit of the G-20 plays out is over the very real dilemma between continuing (as the White House wants) to fund this anemic recovery with yet more borrowed money and deficits or to follow the Germans and British with sharp cuts in public spending and austerity programs to cut deficits. It is an intellectual confrontation between their heirs of two late, great economists, John Maynard Keynes and the monetarist Milton Friedman. Whatever happens on the soccer fields of South Africa in the two next weeks, the tussle between the Keynesians and the Monetarists is the real world cup, with the global economy as the stake.

Share This Article With Planet Earth

Related Links The Economy

Promising Prospects Of Economic Development In Afghanistan

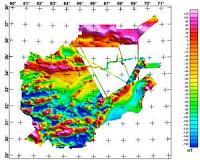

Promising Prospects Of Economic Development In AfghanistanBethesda MD (SPX) Jun 25, 2010 Analyzing nearly 20 terabytes of data collected from 220 mission flight-hours covering more than half of Afghanistan, Naval Research Laboratory and the U.S. Geological Survey investigators reveal several potential major oil and gas sedimentary basins, mineral-rich regions, and hydrologic resources for agriculture and economic development as recently reported by Department of Defense. Fligh ... read more |

|

| The content herein, unless otherwise known to be public domain, are Copyright 1995-2010 - SpaceDaily. AFP and UPI Wire Stories are copyright Agence France-Presse and United Press International. ESA Portal Reports are copyright European Space Agency. All NASA sourced material is public domain. Additional copyrights may apply in whole or part to other bona fide parties. Advertising does not imply endorsement,agreement or approval of any opinions, statements or information provided by SpaceDaily on any Web page published or hosted by SpaceDaily. Privacy Statement |